At Oakmont Financial Services, we want to help you restore your good credit and secure your future through credit repair, credit monitoring credit protection, and credit literacy.

Detect and prevent surprises by keeping watch on your credit report and monitor for fraud and mistakes.

“>For those with minor issues or looking for a small bump to make their next life purchase. Monitoring AND protection 24/7/365.

A dedicated team focused on your personal needs, providing our most aggressive credit repair services to address complex issues fast. For people with major issues needing professional help.

No worries, we can help! Contact us today and our representatives can help you find the plan that would work best for you.

Your credit score is a number that banks, lenders, and credit cards rely on to predict how likely you are to pay back a loan.

Even the simplest of inaccuracies on your credit report can hurt your ability to buy a home, finance a vehicle, or even find employment.

Navigating the waters of credit repair can be daunting on your own. It is important to have a professional with experience on your side.

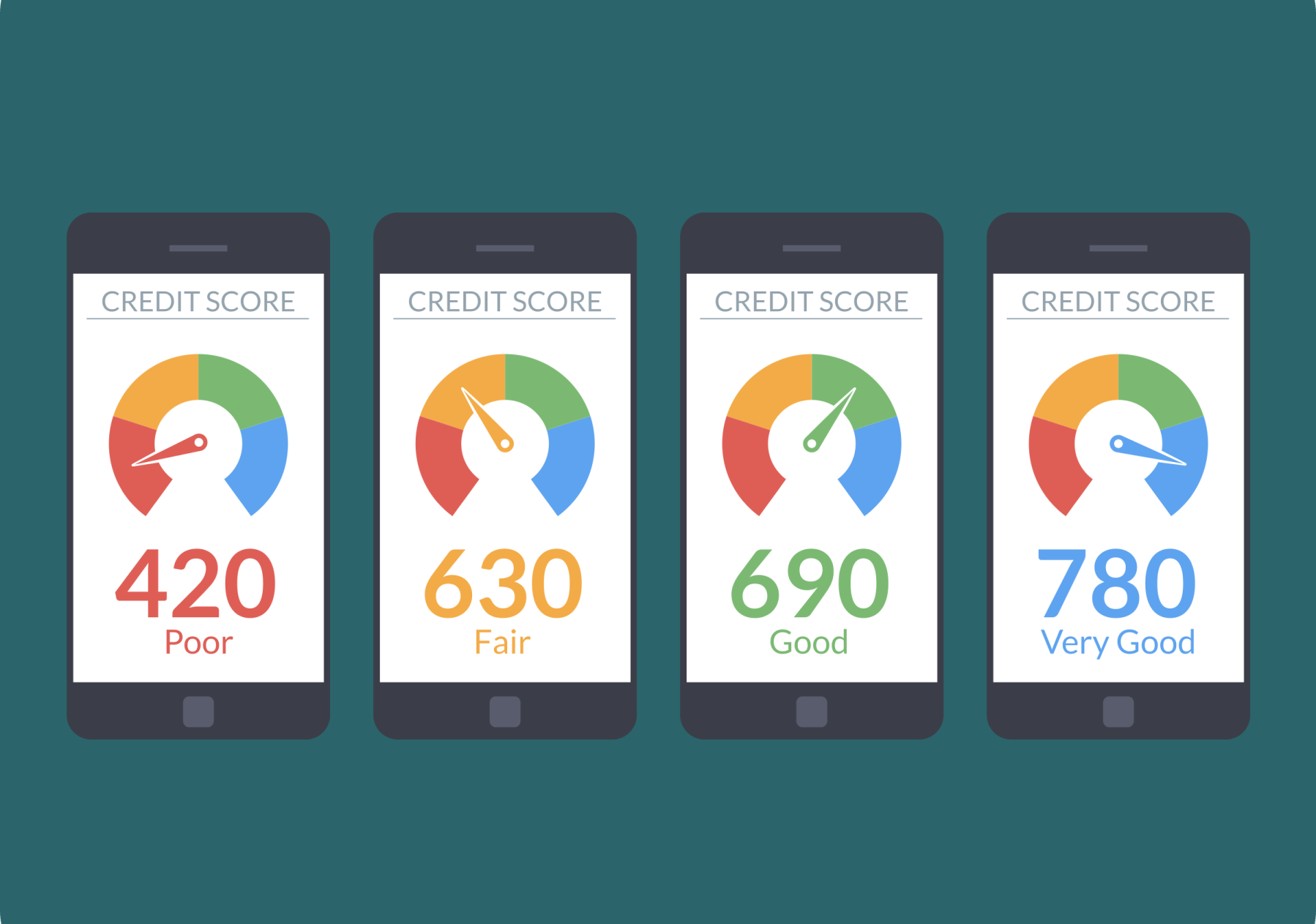

Is your credit score 750 or below?

Do you have debts over 6 months old that are either not your debts, or are reported incorrectly or illegally?

Do you want to improve your credit report and score to purchase a home, automobile, or get a better interest rate?

Do you want to learn how to manage your finances in the future and improve your quality of life?

An error is any item you do not feel is 100% factually correct on your report.

The Fair Credit Reporting Act and other laws give you the right to dispute any item on your credit report, including:

Most of the information on your credit report was put there by a human, and humans make mistakes. At Oakmont Financial Services, we can advocate for you to get those mistakes removed.

Knowledge is power. Learning how to properly manage your credit score is a great way to set yourself up for success in the future. At Oakmont Financial Services, we provide credit coaching and education to help you make positive financial choices and maintain a great credit score, as well as credit monitoring to keep you safe in the future.

Do you have questions? Review some of the most commonly asked questions below.

We work to restore your business or personal credit by:

-Identifying and clarifying any inaccuracies and misunderstandings with Crash

-Writing to creditors to dispute any erroneous negative marks on your credit report

-Negotiating with creditors and debt collectors on your behalf

-Advice on setting up new accounts to add more positive data to your credit report.

Oakmont Financial Services monitors for changes that seem fraudulent or unusual, so that it you can catch them before they destroy your credit score.

Identity IQ is a U.S.-based credit monitoring and identity theft company that we used to help protect your credit.

A score over 720 is usually considered an “excellent” credit score for potential lenders. 690 to 719 is considered a “good” credit score, 630 to 689 is considered “fair” credit, and 629 and below is considered “bad” credit.

You can request a free credit report once a year at AnnualCreditReport.com.

To improve your credit you can make consistent payments on debt, like credit cards, and improve your debt to credit limit ratio. Practicing good financial habits and being smart with credit cards can help keep your credit score in the “good” to “excellent” range.

If you have multiple credit errors on your credit report that are unnecessarily bringing your score down, Oakmont Financial Services can help you get them removed.